Nubank

A new era of finance.

Startup Snapshot:

Startup Name: Nubank

Industry: Fintech, Banking

Founders: David Vélez, Cristina Junqueira, and Edward Wible.

HQ Location: São Paulo, Brazi

Operates in: Brazil, Mexico, and Colombia.

Founded: 2013

Stage: Series E

Investors: Sequoia Capital, Founders Fund, Kaszek Ventures, Tiger Global Management, Goldman Sachs, Berkshire Hathaway, QED Investors and DST Global.

Website: https://nubank.com.br/

Nubank’s Purpose

Nubank is a pioneering fintech company in Latin America, established in 2013 in São Paulo, Brazil with the mission to provide accessible and innovative financial services to empower customers to take control of their finances with convenience.

Nubank's core purpose involves leveraging technology to simplify banking processes, particularly in regions where traditional banking has been limited or inefficient.

With a customer-centric approach, Nubank has become a leading digital bank in Brazil, Mexico, and Colombia, serving millions of customers with its user-friendly mobile app and exceptional customer service.

Nubank’s Offerings

Nubank is a customer-centric financial institution that offers a comprehensive range of financial products and services to cater to its users' needs.

One of its primary offerings is a no-fee credit card that can be managed entirely through a mobile app. This feature enables customers to track expenses in real time, make payments, and access various financial tools seamlessly.

In addition to this, Nubank provides digital savings accounts, personal loans, insurance products, and investment options. All these products have been designed with the user in mind and are easily accessible, making banking simple and convenient.

Nubank by the Numbers

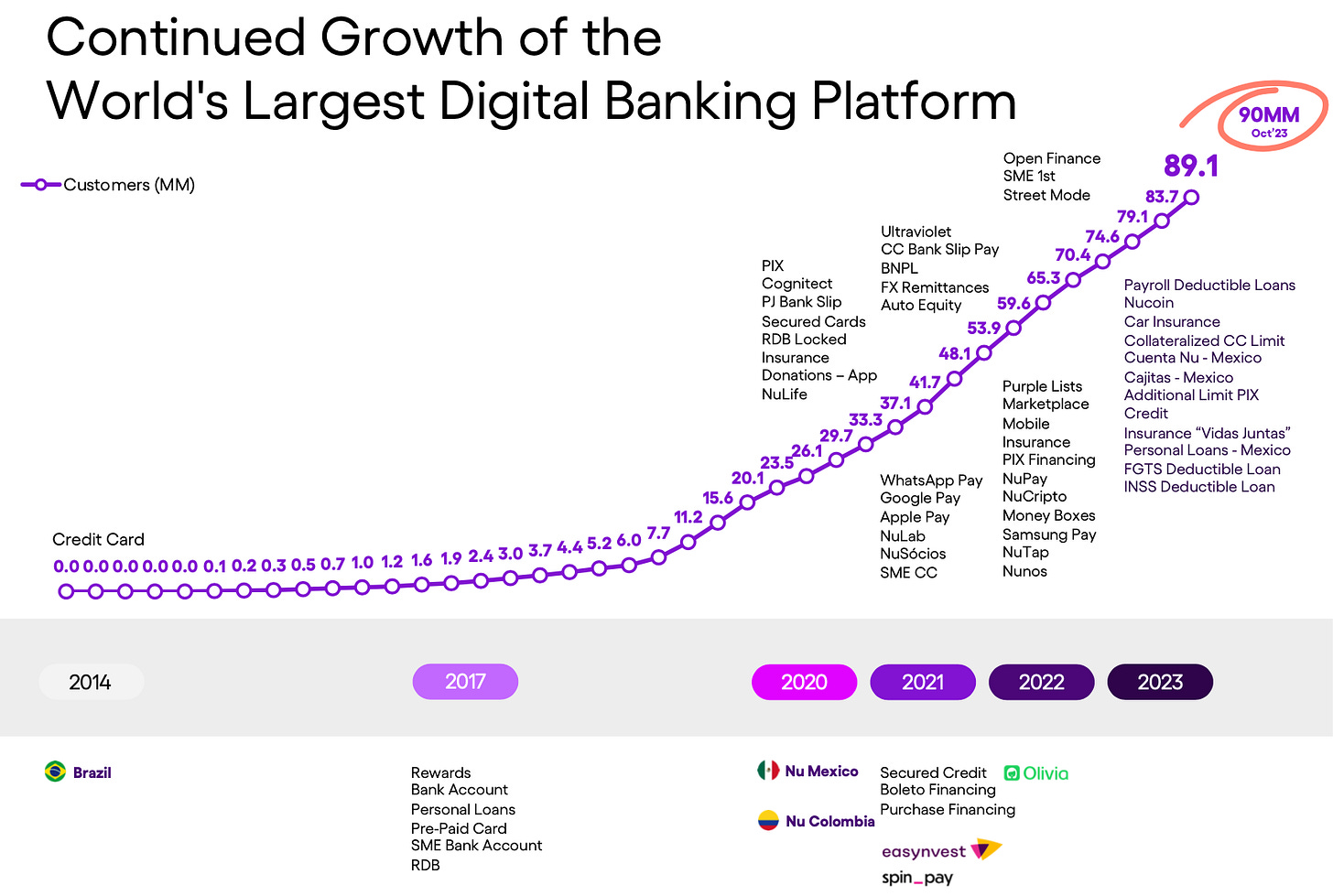

90 million customers.

5th largest financial institution in Latin America by number of customers.

5 million people opened their first credit card or account with Nubank.

10.5 million Nucoin customers.

18.7 million new users in 2023.

1 billion - projected yearly profits for 2024.

2.1 billion in revenue in 2023.

49 billion market cap.

“Position Yourself in the Scarcity, Not in The Oversupply“

David Vélez, Nubank Cofounder

Key Takeaways

Leveraging technology, Nubank simplifies banking processes, especially in areas with limited or inefficient traditional banking access.

Offering a no-fee credit card managed through a mobile app, Nubank enables real-time expense tracking, payments, and access to diverse financial tools.

Nubank's impact in providing financial services to underserved populations is notable, having issued over 5 million people their first credit card or account.

VC Headlines:

Axelerate Talent Network:

Discover amazing opportunities in tech: https://getmatched.axented.com/jobs

Join the network: https://getmatched.axented.com/talent-network

Learn more: https://getmatched.axented.com

Special thanks to our sponsor:

Axented helps businesses design, build, and scale their products and teams worldwide.

With over 10 years of experience and a diverse portfolio of more than 300 projects delivered in over 15 countries, Axented has established itself as a trusted partner in the tech industry.

Renowned for its expertise and commitment to excellence, Axented provides innovative solutions to help businesses thrive in a digital world.

Thanks for reading Founders Launchpad! Subscribe for free to receive new posts and support our work.