Five Top Accelerators Investing in LATAM

From Silicon Valley to Amsterdam: Driving Innovation Across Latin America

Have you found value in our articles and gained new insights? Think of someone who would enjoy the newsletter as much as you do, and share it with them!

Content

Techstars

Y Combinator

500 Startups

Rockstart

Platanus Ventures

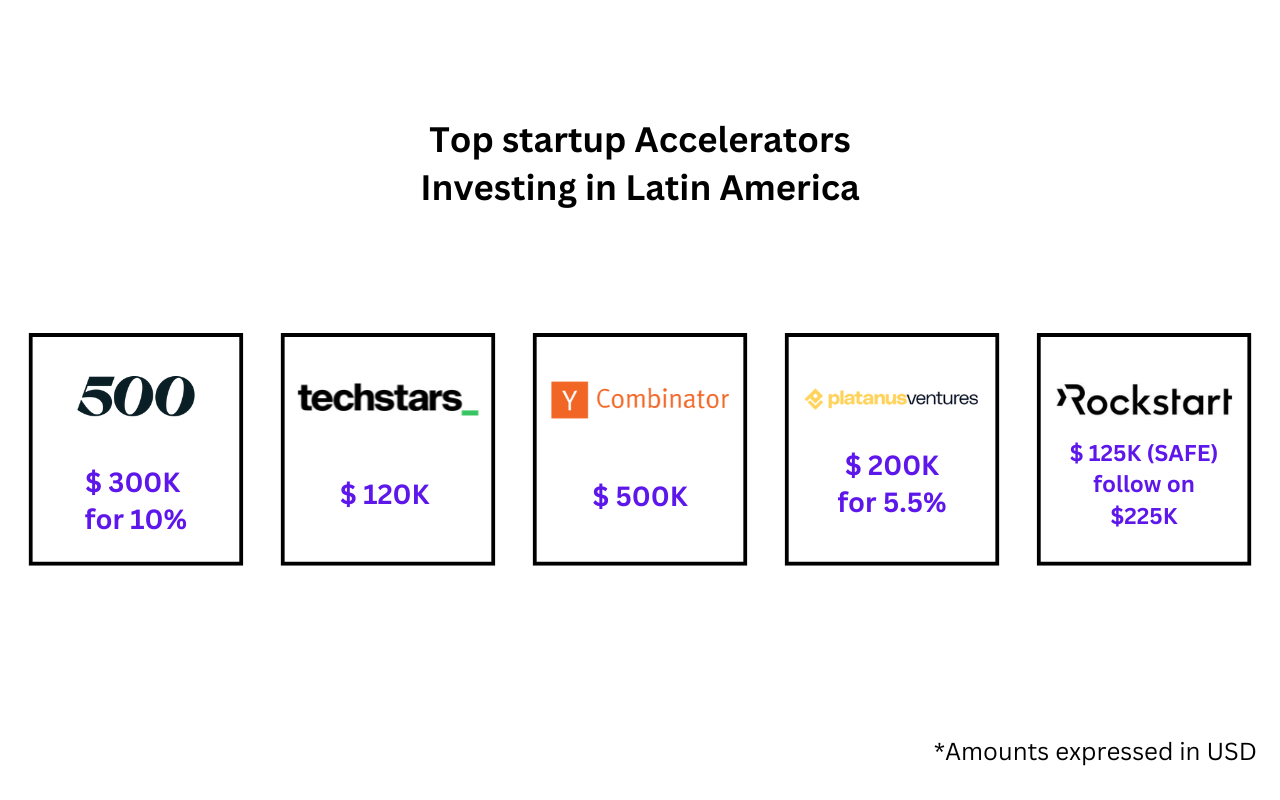

This week’s newsletter highlights five top accelerators investing in the Latin American startup ecosystem. These accelerators include Techstars, Y Combinator, 500 Startups, Rockstart, and Platanus Ventures. They play a crucial role by providing early-stage capital and mentorship. These accelerators don't just invest; they also nurture and support early-stage companies, driving innovation across the region.

Techstars

Techstars is a globally recognized startup accelerator with a significant footprint in Latin America. Founded in 2006 by David Cohen, Brad Feld, David Brown, and Jared Polis, Techstars has established itself as a powerhouse in the startup ecosystem. With over 50 accelerator programs worldwide, including key Latin American hubs such as Bogotá and São Paulo, Techstars offers a comprehensive support system for startups.

Website: https://www.techstars.com/

Location: Global presence with programs in major cities worldwide, including Latin America

Investment Size: $120,000

Deal Structure: $20,000 for 6% equity and a $100,000 convertible note

Focus Areas: Sector-agnostic, supporting a wide range of technology-driven startups

Top Investments: SendGrid, Sphero, ClassPass, DigitalOcean, Outreach

Top Resource: Entrepreneur Toolkit

What sets Techstars apart?

Techstars provides startups access to a global network of mentors, investors, and corporate partners, which is crucial for scaling their businesses. The accelerator’s rigorous programs focus on helping entrepreneurs refine their business models, gain traction, and prepare for subsequent funding rounds. By fostering a collaborative community, Techstars ensures that startups have the resources and support they need to succeed in highly competitive markets.

Y Combinator (YC)

Y Combinator, based in Silicon Valley, is one of the most prestigious startup accelerators globally, significantly impacting the LATAM startup scene. Founded in 2005 by Paul Graham, Jessica Livingston, Robert Tappan Morris, and Trevor Blackwell, YC has funded over 3,000 startups, including tech giants like Airbnb, Dropbox, and Stripe. YC's intensive 3-month program culminates in a Demo Day, providing unparalleled opportunities for growth and investment.

Website: https://www.ycombinator.com/

Location: Silicon Valley, USA

Investment Size: $500,000

Deal Structure: $125,000 for 7% equity and $375,000 on an uncapped SAFE with MFN provisions

Focus Areas: Sector-agnostic, supporting a wide range of technology-driven startups

Top Investments: Airbnb, Dropbox, Stripe, Reddit, DoorDash

Top Resource: Startup School

What sets YC apart?

YC’s alumni network is one of the strongest in the startup world, offering new cohorts the opportunity to connect with successful founders and industry experts. This network and YC’s reputation for producing high-growth companies attract top-tier investors and partners. The program's structured mentorship and intense focus on product development and market fit help startups achieve rapid progress and prepare for substantial scaling.

500 Startups

500 Startups is a global venture capital seed fund and startup accelerator with a strong presence in Silicon Valley and significant influence in LATAM. Founded in 2010 by Dave McClure and Christine Tsai, 500 Startups has supported over 2,400 companies across 77 countries. The accelerator's 16-week program offers comprehensive support to startups.

Website: https://500.co/

Location: Global presence with a strong focus on Silicon Valley, USA

Investment Size: $150,000

Deal Structure: 6% equity stake

Focus Areas: Technology-driven companies across various sectors, including fintech, e-commerce, proptech, and mobility

Top Investments: Canva, Credit Karma, Udemy, Grab, Talkdesk

Top Resource: Venture Education

What sets 500 apart?

The extensive network of mentors and industry experts at 500 Startups provides startups with valuable guidance and connections. The accelerator’s hands-on approach includes regular feedback sessions, workshops, and access to a global community of entrepreneurs. This support helps startups refine their business strategies, scale their operations, and connect with potential investors and partners worldwide.

Rockstart

Rockstart, based in Amsterdam, has extended its reach to Latin America, recognizing its growing potential. Founded in 2011 by Rune Theill, Don Ritzen, and Oscar Kneppers, Rockstart focuses on sectors like energy, health, agrifood, and emerging technologies. The accelerator offers tailored programs that provide substantial support to startups.

Website: https://www.rockstart.com/

Location: Amsterdam, Netherlands, with programs in Europe and Latin America

Investment Size: $350k

Deal Structure: $125K (SAFE) follow on $225K

Focus Areas: Energy, health, agrifood, and emerging technologies

Top Investments: Peerby, 3D Hubs, Healthy Workers, Convious, Mosa Meat

Top Resource: Rockstart Youtube Channel

What sets Rockstart apart?

Rockstart’s programs are designed to tackle global challenges by supporting startups that create innovative solutions in critical sectors. By providing access to a network of experts, investors, and corporate partners, Rockstart helps startups navigate the complexities of their respective industries. The accelerator’s focus on impact-driven ventures ensures that the supported startups are profitable and contribute positively to society.

Platanus Ventures

Platanus Ventures, based in Santiago, Chile, is a key player in the LATAM startup ecosystem. Founded by Tomás Pollak, Ignacio Canals, and Andrés Daza, Platanus Ventures focuses on technology startups with strong technical founding teams. The accelerator offers essential resources and mentorship to achieve growth objectives.

Website: https://www.platanusventures.com/

Location: Santiago, Chile

Investment Size: $200,000

Deal Structure: 5.5% equity stake

Focus Areas: Technology startups, particularly those with a strong technical founding team

Top Investments: Fintoc, Houm, Manutara Ventures, Betterfly, Jetty

Top Resource: Platanus Ventures Youtube Channel

What sets Platanus apart?

Platanus Ventures provides a nurturing environment for tech startups, offering mentorship from seasoned entrepreneurs and access to a network of industry experts. The accelerator’s focus on technical excellence ensures that the startups it supports are well-equipped to develop cutting-edge solutions and compete globally. Platanus Ventures helps startups achieve significant milestones and prepare for future growth by fostering innovation and providing tailored support.

Special thanks to our sponsor:

Axented helps businesses design, build, and scale their products and teams worldwide.

With over 10 years of experience and a diverse portfolio of more than 300 projects delivered in over 15 countries, Axented has established itself as a trusted partner in the tech industry.

Renowned for its expertise and commitment to excellence, Axented provides innovative solutions to help businesses thrive in a digital world.